Payday loan usage dropped during pandemic, but will rebound - Questions

The Best Guide To Payday loan usage dropped during pandemic, but will rebound

Payday advance loan have become the face of predatory lending in America for one factor: The typical rates of interest on a payday advance is 391% and can be greater than 600%! If you can't repay the loans and the Consumer Financial Defense Bureau states 80% of payday advance loan don't earn money back in 2 weeks then the interest rate soars and the quantity you owe rises, making it practically impossible to pay it off.

It'll add up to more than any late charge or bounced check fee you're attempting to avoid. Compare payday advance loan rate of interest of 391%-600% with the typical rate for alternative options like charge card (15%-30%); debt management programs (8%-10%); personal loans (14%-35%) and online loaning (10%-35%). Should payday loans even be considered an option? Some states have actually split down on high interest rates to some extent.

For $500 loans, 45 states and Washington D.C. have caps, but some are quite high. The median is 38. 5%. But some states don't have caps at all. In This Piece Covers It Well , interest can go as high as 662% on $300 borrowed. What does that mean in genuine numbers? It indicates that if it you pay it back in 2 weeks, it will cost $370.

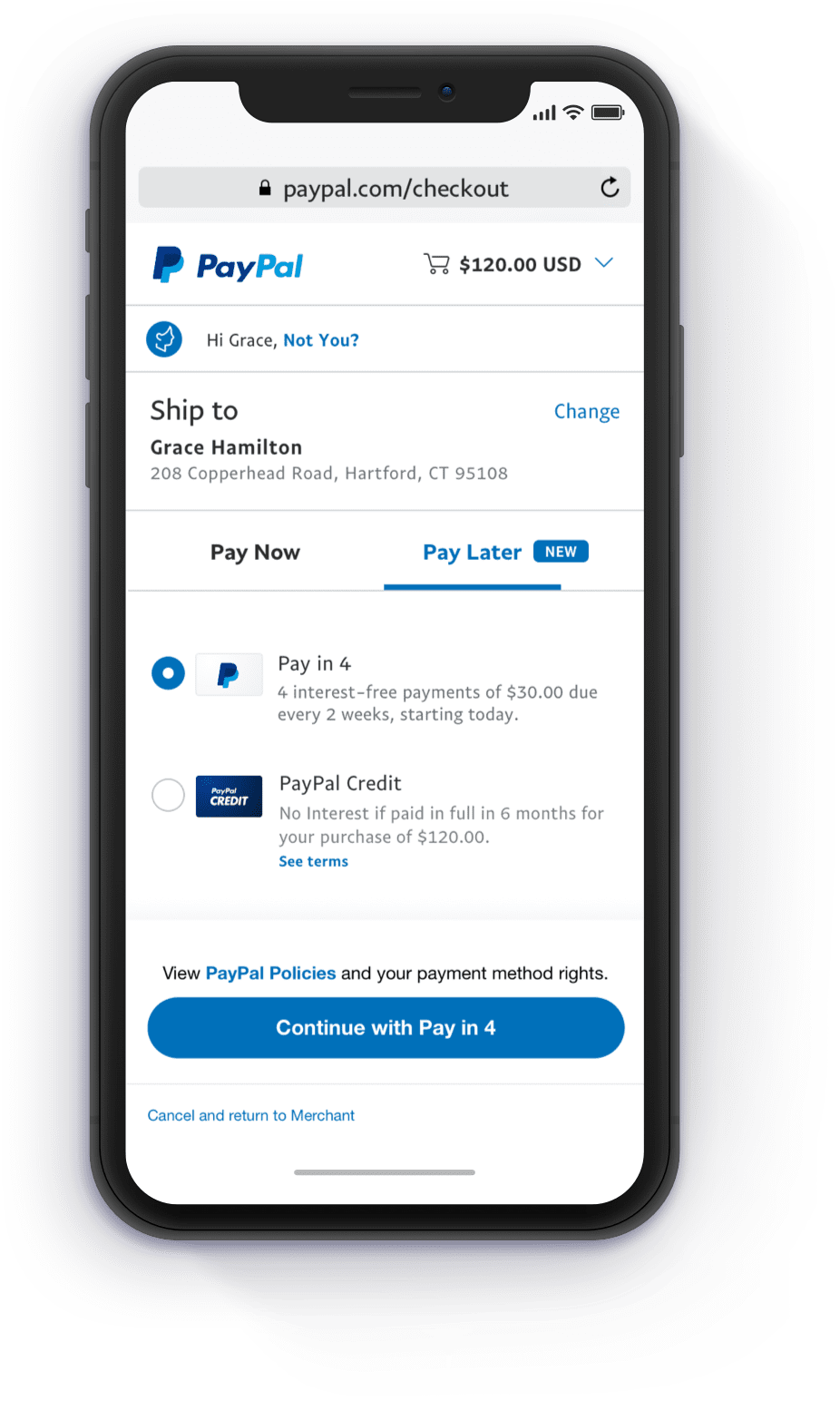

A Biased View of PayPal Begins Taking Applications for Renewed Paycheck

By the method, five months is the average quantity of time it requires to pay back a $300 payday loan, according to the Pew Charitable Trusts. So prior to you get at that quick, very pricey money, understand what payday loans require. Payday Loan Modifications Retracted The Customer Financial Security Bureau presented a series of policy changes in 2017 to assist protect borrowers, consisting of forcing payday lending institutions what the bureau calls "small dollar loan providers" to figure out if the customer might afford to take on a loan with a 391% rate of interest, called the Obligatory Underwriting Guideline.

Paypal's PPP Loan Application Process SUCKS! - YouTube

Get your PayPal Business Loan Approved: From Start to Finish– JerryBanfield.com

A loan provider can't take the debtor's car title as security for a loan. A lending institution can't make a loan to a customer who currently has a short-term loan. The lending institution is limited to extending loans to borrowers who have paid at least one-third of the principal owed on each extension.